business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

IntroductionIn the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.Understanding Wealth TaxWhat is Wealth Tax?Wealth tax is a levy imposed on the net wealth of individuals and companies.

- Cash King PalaceShow more

- Lucky Ace PalaceShow more

- Starlight Betting LoungeShow more

- Spin Palace CasinoShow more

- Silver Fox SlotsShow more

- Golden Spin CasinoShow more

- Royal Fortune GamingShow more

- Lucky Ace CasinoShow more

- Diamond Crown CasinoShow more

- Victory Slots ResortShow more

Source

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

- business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

Introduction

In the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.

Understanding Wealth Tax

What is Wealth Tax?

Wealth tax is a levy imposed on the net wealth of individuals and companies. It is calculated based on the value of assets owned, including real estate, financial investments, and business assets. In the context of online casinos, wealth tax can apply to the profits generated by players and the revenue earned by the casino operators.

Wealth Tax in India

In India, wealth tax was abolished in 2016, but the concept of taxing wealth remains relevant in the form of other taxes such as income tax and capital gains tax. For online casino operators and high-net-worth players, understanding the tax implications is crucial to ensure compliance and avoid legal issues.

Business Game Rules in Indian Online Casinos

Types of Games

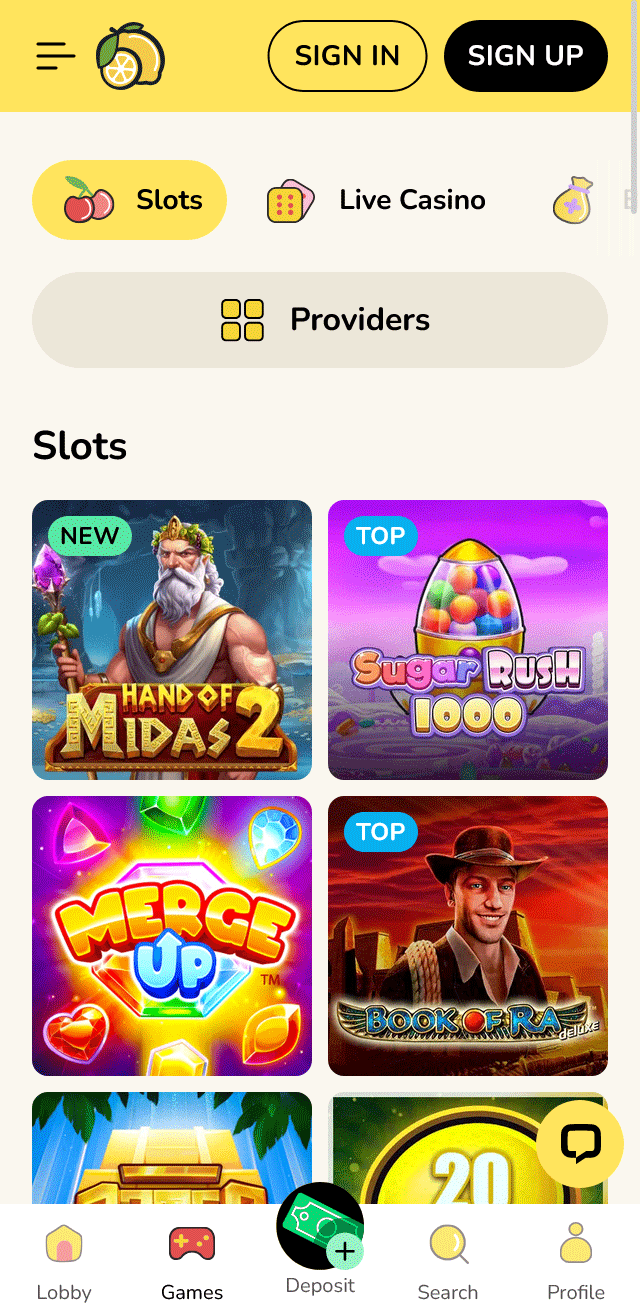

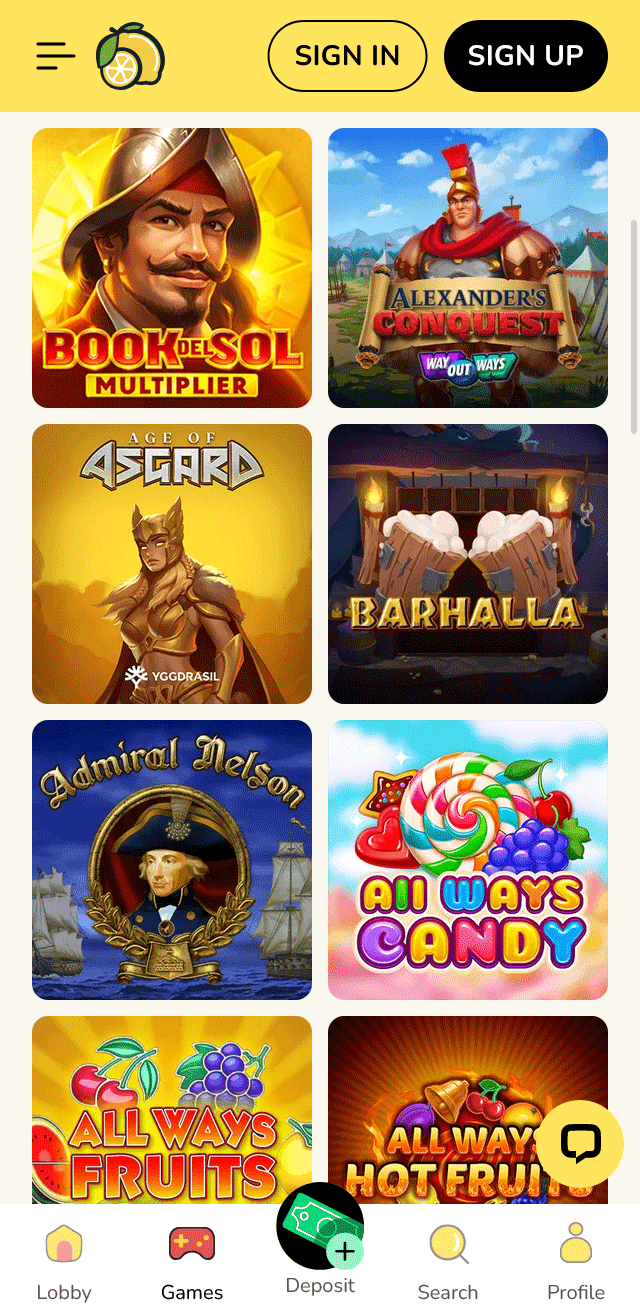

Indian online casinos offer a variety of games, including:

- Baccarat: A card game where players bet on the hand they believe will be closest to nine.

- Electronic Slot Machines: Digital versions of traditional slot machines, offering various themes and payout structures.

- Football Betting: Betting on football matches, including pre-match and live betting options.

- Casino Games: Classic casino games like poker, roulette, and blackjack.

Rules and Regulations

- Age Restriction: Players must be at least 18 years old to participate in online casino games.

- Licensing: Online casinos must be licensed by the relevant authorities to operate legally in India.

- Responsible Gaming: Casinos are required to promote responsible gaming and provide resources for problem gambling.

- Payment Methods: Secure and legal payment methods must be available for deposits and withdrawals.

Wealth Tax Considerations for Players

Reporting Winnings

Players must report their winnings from online casinos as income. This includes:

- Tournament Winnings: Prize money from casino tournaments.

- Jackpot Wins: Large payouts from slot machines or other games.

- Regular Wins: Consistent winnings over time.

Tax Implications

- Income Tax: Winnings are subject to income tax, which varies based on the player’s tax bracket.

- Capital Gains Tax: If winnings are considered capital gains, they may be subject to a different tax rate.

- Deductions: Players can deduct losses from their winnings to reduce taxable income.

Wealth Tax Considerations for Casino Operators

Revenue Reporting

Casino operators must report their revenue accurately to the tax authorities. This includes:

- Gross Revenue: Total income generated from all games and services.

- Operating Costs: Deductions for operational expenses such as salaries, marketing, and technology.

- Profit: Net profit after deducting operating costs from gross revenue.

Tax Compliance

- Income Tax: Operators must pay income tax on their net profit.

- GST: Goods and Services Tax (GST) applies to the services provided by the casino.

- Audit: Regular audits by tax authorities ensure compliance with tax laws.

The business game rules in Indian online casinos, particularly in Mumbai, are governed by a complex interplay of regulations and tax laws. Understanding the implications of wealth tax, both for players and operators, is essential for ensuring legal compliance and maximizing profitability. As the online casino industry continues to grow, staying informed about these rules will be crucial for all stakeholders involved.

slot of income tax

Income tax is a critical aspect of any financial system, and its application in the online entertainment and gambling industries is no exception. This article delves into the intricacies of income tax as it pertains to various sectors within these industries, including online casinos, sports betting, and electronic slot machines.

Understanding Income Tax in the Context of Online Entertainment

Income tax regulations can significantly impact the operations and profitability of businesses within the online entertainment sector. Here’s a breakdown of how income tax applies to different segments:

1. Online Casinos

- Gross Revenue Taxation: Many jurisdictions tax online casinos based on their gross revenue rather than net profit. This means that even if a casino operates at a loss, it may still be liable for tax payments.

- Player Winnings: Income tax may also apply to player winnings, depending on the jurisdiction. For instance, in some countries, winnings from online casinos are considered taxable income.

- Corporate Tax Rates: Online casinos are subject to corporate income tax rates, which can vary significantly from one country to another.

2. Sports Betting

- Betting Taxes: Some regions impose a tax on sports betting activities, either as a percentage of the bet amount or a fixed fee per bet.

- Winnings Tax: Similar to online casinos, winnings from sports betting may be subject to income tax. This can vary based on the amount won and the player’s overall income.

- Corporate Tax: Sports betting operators are also subject to corporate income tax on their profits.

3. Electronic Slot Machines

- Machine Taxes: In some jurisdictions, electronic slot machines are subject to a specific tax, often calculated based on the number of machines or their revenue.

- Winnings Tax: Winnings from electronic slot machines may be taxable, depending on local regulations.

- Corporate Tax: Operators of electronic slot machines are subject to corporate income tax on their earnings.

Strategies for Managing Income Tax in the Online Entertainment Industry

Given the complex nature of income tax regulations, businesses in the online entertainment industry must adopt strategic approaches to manage their tax liabilities effectively.

1. Tax Planning

- Legal Structures: Choosing the right legal structure for the business can help minimize tax liabilities. For example, setting up a company in a jurisdiction with lower corporate tax rates can be beneficial.

- Deductible Expenses: Maximizing deductible expenses, such as operational costs and marketing expenses, can reduce taxable income.

2. Compliance and Reporting

- Accurate Record-Keeping: Maintaining accurate records of all financial transactions is crucial for ensuring compliance with tax regulations.

- Regular Audits: Conducting regular internal audits can help identify potential tax issues and ensure that all tax obligations are met.

3. Utilizing Tax Incentives

- Government Incentives: Many governments offer tax incentives for businesses in the online entertainment industry, such as tax credits for research and development or investment in technology.

- International Tax Treaties: Understanding and utilizing international tax treaties can help reduce double taxation and optimize tax liabilities.

Income tax is a significant consideration for businesses operating in the online entertainment and gambling industries. By understanding the various tax regulations and adopting strategic tax management practices, companies can navigate the complexities of income tax and ensure compliance while maximizing profitability.

online games for cash prizes in india

India has witnessed a significant surge in the popularity of online gaming over the past few years, with millions of players engaging in various forms of virtual entertainment. One aspect that has gained considerable attention is online games that offer cash prizes to winners. In this article, we will delve into the world of online gaming for cash prizes in India, exploring its types, rules, and regulations.

Types of Online Games for Cash Prizes

Several types of online games in India offer cash prizes to players. Some of these include:

- Skill-based games: These are online games that require a certain level of skill or strategy to play. Examples include poker, rummy, and chess.

- Fantasy sports: This type of game involves creating virtual teams of real-life athletes and competing against other players based on the performance of their selected team members.

- Casino-style games: Online casinos in India offer various games like slots, blackjack, and roulette, where players can win cash prizes by chance.

Rules and Regulations

Online gaming for cash prizes in India is subject to certain rules and regulations. Some key points to consider include:

- Age restrictions: Most online gaming platforms require players to be at least 18 years old to participate.

- KYC (Know Your Customer) verification: Players may need to provide identification documents to verify their age and identity.

- Taxation: Winnings from online games are considered taxable income in India. Winners must report their winnings to the tax authorities.

Popular Online Gaming Platforms

Several popular online gaming platforms in India offer cash prizes to players. Some of these include:

- Paytm First Games: A leading online gaming platform that offers a wide range of games, including skill-based and fantasy sports.

- Adda 52: An online casino platform that provides various games like poker, blackjack, and roulette.

- Fantasy Power 11: A popular fantasy sports platform that allows players to create virtual teams and compete against other users.

Online gaming for cash prizes in India is a rapidly growing industry, with millions of players engaging in various forms of virtual entertainment. By understanding the types of games available, rules, and regulations, as well as popular online gaming platforms, players can make informed decisions about which games to play and how to participate safely.

Note: The content provided is for informational purposes only and should not be considered as legal or financial advice. Players are advised to research and understand the terms and conditions of each game before participating.

**win real money gambling online: tips, strategies, and legal considerations**

Gambling online offers the thrill of potentially winning real money from the comfort of your home. However, it’s essential to approach this activity with a strategic mindset and a clear understanding of the legal landscape. This article provides tips, strategies, and legal considerations to help you maximize your chances of winning while staying within the bounds of the law.

Tips for Winning Real Money Online

1. Choose the Right Games

- Understand the Odds: Different games have different odds. For example, blackjack and video poker offer better odds than slot machines.

- Play Games with Low House Edge: Games like baccarat, craps, and certain types of poker have a lower house edge, increasing your chances of winning.

2. Manage Your Bankroll

- Set a Budget: Determine how much money you can afford to lose and stick to it.

- Use Bonuses Wisely: Many online casinos offer bonuses. Use them strategically to extend your playing time and increase your chances of winning.

3. Practice with Free Games

- Play Free Versions: Many online casinos offer free versions of their games. Use these to practice and develop your strategies without risking real money.

4. Stay Informed

- Learn the Rules: Familiarize yourself with the rules and strategies of the games you plan to play.

- Stay Updated: Keep up with the latest trends and strategies in online gambling.

Strategies for Winning Real Money Online

1. Develop a Strategy

- Card Counting in Blackjack: While card counting is more challenging online due to continuous shuffling machines, some strategies can still be effective.

- Betting Systems: Systems like the Martingale, Paroli, and Fibonacci can help manage your bets and potentially increase your winnings.

2. Use Technology to Your Advantage

- Gambling Software: Use software that helps analyze games and provide insights.

- Mobile Apps: Many online casinos offer mobile apps that allow you to play on the go.

3. Join Loyalty Programs

- Earn Rewards: Many online casinos have loyalty programs that offer rewards, bonuses, and other perks for frequent players.

- VIP Programs: Higher-tier VIP programs can offer exclusive benefits, including better bonuses and personalized service.

Legal Considerations

1. Know the Laws in Your Jurisdiction

- Legal Age: Ensure you meet the legal age requirement for gambling in your country or state.

- Licensed Casinos: Only gamble at licensed and regulated online casinos to ensure fair play and secure transactions.

2. Understand Tax Implications

- Tax on Winnings: In many jurisdictions, gambling winnings are taxable. Consult with a tax professional to understand your obligations.

- Record Keeping: Keep detailed records of your winnings and losses for tax purposes.

3. Protect Your Personal Information

- Secure Transactions: Use secure payment methods and ensure the casino uses encryption to protect your financial information.

- Privacy Policies: Read the casino’s privacy policy to understand how your personal information will be used and protected.

Winning real money gambling online requires a combination of strategic play, informed decision-making, and adherence to legal guidelines. By choosing the right games, managing your bankroll effectively, and staying informed about the legal landscape, you can enhance your chances of success while enjoying the excitement of online gambling. Remember, gambling should always be approached responsibly, and it’s crucial to set limits to ensure it remains a fun and enjoyable activity.

Frequently Questions

What are the business game rules for wealth tax in India, particularly for online casinos in Mumbai?

In India, the business game rules for wealth tax, including for online casinos in Mumbai, are governed by the Wealth Tax Act of 1957. This act was repealed in 2016, and wealth tax was subsumed under the Income Tax Act. Currently, wealth tax is not applicable, but online casinos must adhere to income tax regulations. Operators must declare their income from online gambling and pay taxes accordingly. Additionally, they must comply with local regulations and obtain necessary licenses. For precise details, consulting a tax expert or referring to the latest Income Tax Act provisions is advisable.

How do wealth tax rules apply to business games in India, especially for online casinos in Mumbai?

In India, wealth tax rules apply to business games, including online casinos in Mumbai, by assessing the net wealth of individuals and businesses. The Wealth Tax Act of 1957 imposes a tax on the net wealth exceeding a specified threshold. For online casinos, this involves calculating the value of assets, including business holdings, less allowable deductions. Mumbai, being a financial hub, ensures strict compliance with these regulations. Operators must maintain accurate records and file timely returns to avoid penalties. Understanding these rules is crucial for legal operations and financial planning in the gaming industry.

How to Play Andar Bahar Slots Game in Hindi?

Andar Bahar slots game खेलने के लिए, सबसे पहले एक विश्वसनीय ऑनलाइन कैसीनो में जाएं जो हिंदी में उपलब्ध हो। खाता बनाएं और जमा करें। गेम खोजें और 'Andar Bahar' चुनें। एक कार्ड खींचें और 'Andar' या 'Bahar' में से एक पर शर्त लगाएं। यदि आपकी शर्त जीतती है, आपको भुगतान मिलेगा। हिंदी में निर्देशों का पालन करें और गेम का आनंद लें। ध्यान रखें कि जुआ में जोखिम होता है, इसलिए जिम्मेदारी से खेलें।

What is the comprehensive online casino wiki?

The comprehensive online casino wiki is an extensive, user-friendly resource designed to provide detailed information about online casinos, games, strategies, and industry news. It covers a wide range of topics including game rules, bonuses, payment methods, and responsible gambling. This wiki aims to educate both beginners and experienced players, offering insights into the best practices and latest trends in the online gambling world. By consolidating a wealth of knowledge, it serves as a one-stop guide for anyone interested in the online casino experience, ensuring they have the information needed to make informed decisions and enhance their gaming experience.

How do casino rules and regulations differ across various gaming establishments?

Casino rules and regulations vary significantly across different gaming establishments due to local laws, cultural norms, and business practices. In the United States, casinos must adhere to state gaming commissions' strict guidelines, which include age restrictions, game fairness, and responsible gambling measures. In contrast, European casinos often have more relaxed rules, such as lower minimum bets and a broader range of games. Asian casinos, particularly in Macau, focus heavily on VIP services and high-stakes gaming, with unique rules tailored to attract wealthy clientele. Additionally, online casinos have their own set of regulations, often governed by international bodies to ensure global standards of fairness and security. Understanding these differences is crucial for both players and operators to navigate the diverse landscape of gaming establishments.